Listen up! I, Ayden, will be the first person to tell you that private scholarships can be of great help when it comes to paying for your higher education, given that you have your strategy and put in the time and effort.

However, it is super important to also be aware of the other various forms of aid that you might be eligible to receive so you don’t miss out on any opportunities to lessen your college costs. So, in this post, I am going to discuss another common form of aid that tends to get overlooked: state-based aid!

Every state within the US offers its eligible residents at least one, if not multiple, opportunities to get some help in paying for school. While the majority of these state-run programs only require you to have filed your FAFSA in order to be considered, there are some that have additional application requirements and guidelines, or may even ask you to complete a separate application altogether.

Speaking of the FAFSA, have I mentioned the importance of filing early? As I mentioned, a lot of these state-based aid programs require you to have filled out the FAFSA in order to be considered.

In addition to this, state programs sometimes also operate on a first-come, first-serve basis. This essentially means that it is of the utmost importance to complete your FAFSA on time, if not as early as possible, in order to maximize the amount of aid you can possibly receive.

Below, I have outlined most, if not all, of the state-based aid programs and resources that are available to students all across the US. Simply search for your state, and click around to read more on the various forms of aid that you might be eligible to receive.

Amount: $1,000 per quarter

Deadlines: March 31, June 30, September 30, December 31

Eligibility: Open to all high school, college, and graduate students! No essay or minimum GPA required to apply. Open to US citizens, international students in the US, and students with DACA and undocumented status.

Amount: $1,000 twice per year

Deadlines: June 30, December 31

Eligibility: Open to high school students of all years. No essay or minimum GPA required to apply. Open to US citizens, international students in the US, and students with DACA and undocumented status.

One of the biggest (and possibly best) perks of being a student is the fact that discounts and deals for students are extremely abundant. Being aware of these student deals is super important because it means you will (hopefully) save lots of money on your purchases, which is an important piece of the pie if you are trying to work on your financial fitness and budgeting.

Luckily, lots of big companies offer student deals. Below, you will find my list of about 30 of them! However, remember that just because a company or shop is not on this list, does not mean that they don't offer student deals! So, when you are doing your shopping online or in-person, always be sure to inquire if the store has a discount for students (hint: they usually do!).

Ultimately, whether you’re on campus this semester or not, you won’t want to miss out on these student deals.

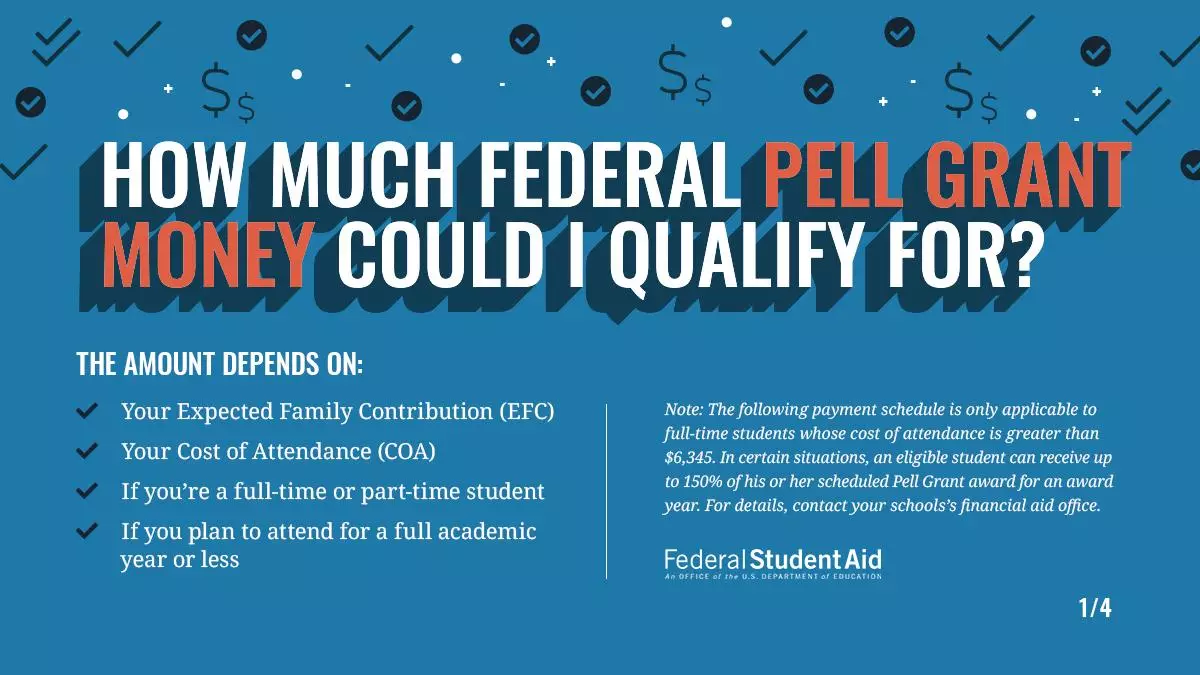

Before we get into the nitty-gritty of Pell Grants, let’s first clarify some of the basics.

What is a Pell Grant, anyways?

Pell Grants are subsidies given out by the U.S. federal government to help students from lower-income families pay for college. Unlike normal loans, Pell Grants usually do not have to be repaid.

However, there are a few reasons why your Pell Grant may have to be repaid, such as if you withdraw from your program early or if you receive outside scholarships or grants that reduce your need for federal student aid.

The purpose of the Pell Grant is to ensure that “higher education remains accessible to all”; therefore, Pell Grant recipients must prove that they fall into a specified level of financial need.

To determine your level of financial need, you will be required to fill out the FAFSA (free application for student financial aid). For reference, the FAFSA should get filled out the first time when you are a high school senior, and you must reapply for every year you are enrolled in college in order to receive funds.

The process of filling out the FAFSA will then determine your eligibility for the grant.

Generally, the majority of Pell Grant recipients come from households with total incomes of less than $25,000 per year.

The amount of the grant can vary from year to year; for the 2020-2021 year (July 1, 2020 - June 30, 2021), the maximum amount any student can receive is $6,345.

According to Studentaid.gov, the amount you can expect to receive depends on a number of factors, such as:

For more information on how the amounts are determined, visit this link to view the tables for the 2020-2021 award year (calculated by the U.S. Department of Education).

Once you receive a Pell Grant, in order to maintain it (aka, keep the money!), you must maintain your enrollment in a U.S. undergraduate program.

Additionally, you must make sure to fill out the FAFSA form each year you are in school, which ensures that you are still eligible for federal student aid.

More information on the FAFSA is available here.

Now that you know everything there is to know about the Pell Grant, if you believe you may be eligible, follow the steps below to apply!

With that, I'll leave it to you. Happy applying!

Luckily, you've come to the right place!

In addition to the resources on my blog about all things financial aid and paying for college, I also have a great scholarship search engine tool that you can use to find awesome opportunities to apply for.

There are scholarships out there of all kinds (ranging from easy to competitive), for students of all years (think: high school juniors to graduate students), and for all amounts (from $500 awards to full-rides).

Also, if you want to stay updated on the latest scholarship opportunities, I recommend you check out and throw me a follow on Instagram, where I post about awesome scholarships on the reg!

When I was in high school, if you asked me the difference between a scholarship and a loan, I could most likely tell you that. However, any more detailed talk of the various forms of financial aid/paying for school definitely got me confused.

Now, I want you all to learn from my mistakes! I think it is super important (and I want to ensure) that YOU are fully knowledgeable and aware of all the options and resources that you have at your disposal.

If you’re reading this and you are currently enrolled in college or grad school, you may be thinking, how is this even relevant to me if I’m already there?!

My answer for you is, learning more about the different ways you can fund your education is crucial, no matter what stage in the process you’re at. Maybe you’re a freshman or a sophomore in college, and you’ll learn something that might cause you to rethink your financial strategy going forward.

So, without further ado, here is my quick guide on all of the ways you can pay for college.

Scholarships, also known as grants, are awards that you can receive on the basis of merit (academic performance), financial need, or other components.

Money that you earn from scholarships can be a real game-changer because that money does not ever need to be repaid. So, once you’ve earned it, it’s yours to put towards paying for college.

Thousands of private organizations and businesses (think: Coca-Cola, McDonald's, and Google on a large scale) offer scholarship opportunities for students to apply for.

Applying for private scholarships can be a great way to earn some extra cash to help you pay for school. These scholarships can range from a few hundred dollars to full-ride opportunities, so definitely don’t underestimate the potential earnings here.

If you’re just starting out in the scholarships world and you have little or no idea where to start, luckily for you, I have tons of blog posts to highlight scholarships in different categories, such as no essay scholarships, STEM scholarships, and scholarships for women. Head to my blog to check out more posts like these!

There are several scholarships and grants that you might automatically be eligible for receiving when you file your FAFSA each year, such as the Federal Pell Grant.

If you’re in high school, then in addition to being considered for federal grants through the FAFSA process, you will also find out once you hear back from the colleges you’ve applied to about whether or not you have qualified for any of their specific scholarships.

It is super important to make sure your FAFSA gets submitted as early as possible (well before the final FAFSA deadline!), to ensure that you receive all of the aid that you are potentially eligible for.

College-specific scholarships often take into account your standardized test scores, grade point average, and other components of your academic performance. These scholarships can range from a few thousand dollars each year to $20,000+ per year (some students might even qualify for a full-ride!).

If you’re still in the process of looking at schools or even applying for college and you are trying to be as cost-efficient as possible (who isn’t?!) I recommend you do some research on the approximate costs of each school that you are interested in attending.

Each school likely has what’s called a net price calculator on their website somewhere (probably in the financial aid section) that will allow you to calculate a more accurate overall cost after scholarships and grants are subtracted from the equation.

Most US colleges and universities participate in what is called federal work-study programs.

These programs provide part-time jobs (on and off campus) to both undergrads and grads who have financial need. The cool thing about federal work-study programs is that they encourage students to pursue part-time employment in an area that is related to their area of study, while also giving them an extra way to pay for college.

With federal work-study, you're guaranteed to earn at least the federal minimum wage in any job you hold, however, you can definitely be paid more depending on your experience and level of financial need.

Income from any part-time jobs or internships you might secure near campus or over the summer break will most likely not be enough to fully cover your college costs (especially due to the fact that college costs are rising to crazy high amounts these days).

However, it can certainly be a great help in covering some of the additional expenses that you will probably encounter during your time in school, such as textbooks, supplies, technology, etc. As a bonus, work experience can be a great way to help prepare you for the "real world" and give you a better idea of what you're interested in pursuing for a career!

Throughout my four years of college, I was able to make some extra cash mostly through summer internships, but I also had a part-time job at an event center one semester that was helpful for offsetting some of the costs for my following semester abroad.

If you’re interested in working a part-time job during the school year, I highly recommend you head over to your school’s online job board (most universities have them) and check out some of the options that might be open and available near you.

If you’re looking for internship opportunities, I suggest creating an account on LinkedIn (if you don’t have one already) and looking at the internships (summer, winter, and spring) that many companies have for students.

I also recently released an eBook designed to walk you through all the steps of creating a LinkedIn profile, resume, and cover letter to apply for jobs and internships, which you can download here!

A great option for families to take advantage of when it comes to saving money for college is the 529 plan. 529 plans are beneficial because they “provide tax-free growth and tax-free withdrawals for qualified education expenses, such as tuition, room, board, fees, and books”.

Despite all of their benefits, surveys show that back in 2017, only roughly 17% of students under the age of 18 had 529 plans. If you’re prepping for college and haven’t already had the financing college conversation with your family members or other relevant people, I suggest you do so ASAP, and ask them if you have a 529!

Even if you don’t have a 529 plan, family savings and income are a common method of paying some of the costs of college or graduate school. If you have the means to pay off any of your higher ed costs through yours or your family’s income, it is a better alternative to taking out loans that have to be repaid with interest.

Due to the unfortunate fact that any money you borrow through loans to pay for college needs to be paid back (with interest), I have placed loans at the way bottom of the hierarchy here.

Despite their place in the hierarchy, loans are, for the majority of students, an essential piece of the paying for college puzzle, especially because not everyone can earn thousands of dollars through grants and scholarships! Once you graduate, it may be wise to consolidate you loans. Use this handy student loan consolidation calculator to estimate if it's right for you!

To start, the federal government offers a few different student loan options to help you pay for college. If you file the FAFSA (which you ABSOLUTELY SHOULD!!), you will probably find that your financial aid package will include loans that you are qualified to receive.

There are a few different types of federal loans, and to be honest, no one can outline them all better than the Student Aid website itself. So, head over to the Student Aid website if you want to learn more about the different types of federal loans that are available.

The amount that you're eligible to receive through federal loans varies depending on your level of financial need, the type of degree you are going for, your dependency status, and other factors, which all eventually come together through a (complicated) formula to give you an EFC (Expected Family Contribution).

When you take out money through federal loans to pay for college, you do not need to start paying back the money you borrowed until you graduate or drop down to below part-time enrollment.

The other common form of loan that you might take out to help you pay for college is private loans.

You should only really revert to applying for private student loans if you have maxed out in terms of what you are able to receive through federal loans and you still have outstanding college costs that cannot be covered through any of the other aforementioned methods.

One thing to note about private loans is that they often have fewer benefits for students than federal loans, which usually have lower interest rates and the possibility for student loan forgiveness down the line.

So, if you have to go down the path of taking out loans, which is totally normal, consider federal loans before private. If you have already taken out loans and are looking to trim your payments, you may want to conserve a private student loan consolidation.

Although it is not considered an actual method of paying for school, another strategy that is becoming increasingly popular (especially amid this pandemic) is students enrolling in community college for a year or two and later on transferring to a four-year college or university.

The benefits of doing this can be huge. Oftentimes at a traditional four-year college or university, the majority of your first and even second years can consist of those “gen-ed” classes that all students have to take.

If you are looking to be cost-conscious, the general consensus is that it really doesn’t matter if you take those general classes at a community college and later on transfer to a four-year college or university to finish out your degree. So, if you’re in high school and you’re worried about paying for your higher education, consider looking into this as an option for reducing some of those costs.

This “quick guide” ended up being longer than I intended but at the end of the day, I hope you have found it helpful in terms of highlighting all the ways you can pay for college.

Hello! I can’t believe that it is almost the middle of March as I write this (time just feels like it has been flying by during COVID) but I do have a timely announcement and news to report!

If you keep regularly up to date with my posts on the gram, you might probably already know what I’m about to announce.

But, if you don’t, then, as I said, I have news!

Over the past few months, I have had the chance to speak with dozens, if not a few hundred, students who have expressed concern over not being able to pay for their higher education tuition.

Throughout these chats, I was also doing my own research to see if I could find any concrete numbers that echoed the claims of the students I was speaking to. I was both saddened and shocked to find out that this survey of over 10,000 students across US colleges and universities published last June by OneClass revealed that 56% of students can no longer afford their higher education tuition.

56% Of course I wish that this percentage would be 0, but as far as numbers go, 56% is far too high for my liking.

This led me to the conclusion that in addition to my free website, my own two scholarships that are currently running ($500 Self-Reflection Scholarship and the normal $1,000 no essay scholarship), and the resources I provide, as a player in the higher ed space, I need to go even further in supporting students on their quest to receiving a higher education.

To do this, I decided to do what any newly-born startup would do...to fundraise!

For the entire month of March, I am asking businesses, family, friends, and the larger community to consider making contributions or sharing my fundraiser to help students fund their higher education.

Every penny of the money donated will go directly towards providing crucial financial support to less-privileged students, who have been working hard at trying to find alternate sources of income in addition to applying to scholarships (an endeavor which, as we all know, unfortunately does not guarantee success).

If you’re a student, and you’re currently reading this, you are probably wondering about some of the logistics of this fundraiser, such as

These are all extremely valid questions, which I am now going to answer!

I decided that I wanted to make it super easy for students to be able to sign up to be considered for. So, as a student, all you need to do is enter for my $1,000 Too Cool to Pay for School scholarship in order to be automatically considered.

As a reminder, the Too Cool scholarship is open to all high school, college, and graduate school students in the US, including permanent residents and students with DACA status. If you are an international student studying in the US, you are also eligible to apply, as long as you have a current home address in the US.

If you’ve read the details of my $1,000 scholarship, you already know that the quarterly winner is chosen by random drawing. While that is fine for our quarterly scholarship, my intention with this fundraiser is to ensure that the money we raise goes out to students who need it the most.

So, in order to decide the winners of the GoFundMe fundraiser money, we will be picking students by random generator. Once we have randomly picked a group of students, we will then reach out via email and ask for a copy of your FAFSA Student Aid Report, along with a written response of up to 250 words explaining your current circumstances and why winning the money from this fundraiser is important to you. In order to make the final decisions, we will be considering both your FAFSA EFC and your written response.

With that, I think that pretty much explains all of the details of my fundraiser for Higher Education.

We will be raising money until March 31st, which is the last day for students to enter for our scholarship. I am super excited to say that we recently broke $1,000, which is enough to give out two $500 scholarships! My ultimate goal is to raise $3,000, which would be enough provide some help to 6 students who need the support.

However, we still have quite a long way to go in order to reach our goal.

That’s why I would LOVE it if you would help me out, and share this link with your friends, family, larger community, and anyone who you think might be interested in helping out students in need.

Thanks so much, and be sure to keep an eye out on the Access Scholarships website and social media channels, where I will continue to document our fundraising progress, and eventually, announce the winners!

The COVID-19 pandemic has successfully inserted itself into essentially every aspect of our lives at this point, and unfortunately, it has mostly not been for the better, although any optimist will likely be quick to highlight those few gold nuggets and silver linings.

One particular area of the population that has been struggling to navigate these turbulent times is the area containing prospective, current, and recently graduated college students. With the costs of higher education only on the rise and the rough circumstances of the pandemic leaving millions of people jobless or furloughed until further notice, families are struggling to come up with the funds to pay for or pay off college-related expenses.

Enter all the news on newly-elected president Joe Biden’s plans and proposals to both provide some much-needed relief to those being weighed down by the burden of thousands in student loans while also lowering the costs of tuition for many current and future college students.

In this post, I will highlight several areas of Biden’s currently enacted and proposed plans as they relate to student loans, college tuition, and higher education in general. Keep reading for the tea!

During his first day in office, President Joe Biden made the move of extending student loan payment forbearance to September 30, 2021, a decision made primarily due to the pandemic and its detrimental impact on millions of Americans.

Essentially, this means that the majority of federal student loan payments are on pause, and any new interest on loan balances will be waived.

In addition to this push back on the date, Biden and his team are also pushing for an immediate canceling of $10,000 of student loan debt for all, a move which would “wipe out debt completely for nearly 15 million borrowers who owe $10,000 or less” (Nerd Wallet).

Along with the immediate $10,000 cancellation, Biden has also recommended that federal student debt should be completely canceled for borrowers who attended a public college or university and currently earn less than $125,000.

One important thing to note about this recommendation is that it does not apply to graduate school tuition.

Essentially, Biden’s revised plan proposes that borrowers would not have to start paying back their loans until they earn an annual income of over $25,000.

Once borrowers earn over this number, their repayment plan would then cap at 5% of disposable income, a much more reasonable number than the current options, in which the minimum is set at 10% of disposable income.

Not only is Biden proposing to make monthly student loan payments more reasonable, but he is also pushing to make it so the remainder of your student loan balance will be automatically forgiven after 20 years of payments.

This is in comparison to current repayment plans, which offer forgiveness after 20-25 years of payments.

Students whose family incomes are less than $60,000 per year are eligible for either some or all of a Federal Pell Grant, which is currently worth $6,345.

While this is a great help, it still leaves quite a bit of tuition and expenses on the table for the majority of students attending four-year colleges.

Biden hopes to increase this number while simultaneously loosening the eligibility rules so that Pell Grants can be given out to more “middle-class” students.

Perhaps the most noteworthy part of Biden’s plan is his proposal to make undergraduate tuition-free for students who fall into the following areas:

1) if you attend a public college or university and your family income is below $125,000 (4 years tuition-free)

2) if you attend a community college (2 years tuition-free), and

3) if you attend an HBCU or a tribal college or university (2 years tuition-free).

Students should note that these free college tuition plans do not include non-tuition expenses such as room and board, textbooks, and other fees.

So, I’ve covered quite a bit of information regarding Biden’s current and potential future plans of action as they relate to student loans and college tuition.

I’d be remiss to end this post without quickly elaborating on exactly how these current and future plans can actually impact you! Here’s the lowdown…

If you are a college graduate and you have debt - congrats! Well, not about the debt, but because Biden’s extension of student loan payment forbearance means that if you are not currently in the position to be paying off your student loans, then you can put that worry on the back burner for a few more months.

Lots of people have been asking questions along the lines of “If I am still in a position to be paying off some of my student loans during these difficult times, should I be doing so?”.

Since I am very admittedly no financial expert, here is a little nugget of advice that I found while perusing Student Aid’s section on Student Loan Payment Forbearance:

“Continuing to make payments during the payment suspension could help you pay down your loan balance more quickly because the full amount of a payment will be applied to principal once all interest accrued prior to March 13, 2020, is paid.

You may either leave your loans in the “administrative forbearance” status (meaning the requirement to make payments is suspended) and make payments anyway, or opt out of the administrative forbearance/suspension of payments and continue to make payments.”

- (Studentaid.gov)

If you’re looking for a more in-depth answer, I highly suggest clicking the hyperlink above and reading through all of the Q & A’s on COVID Forbearance and how it all works. If you have any other questions that Student Aid has not covered, be sure to reach out to your specific student loan servicing company to get those clarified.

If you are a current college student - Now, if you are still enrolled as an undergraduate student at a college or university, unfortunately, Biden’s current plans and hopeful proposals in relation to paying off student loans don’t quite impact you just yet.

Usually, you are not required to start paying off student loans until an average of 6 months after you have actually graduated, so even if you’re a college senior graduating this May, Biden’s extension likely won’t impact you too much either, unless it gets extended again of course!

If you are a future college student - Pay close attention to the latest news and updates on Biden’s plans to hopefully expand the eligibility rules for students qualifying for federal Pell Grants as well as information on actually transitioning to making college tuition-free for students under certain circumstances.

So, quite a bit of information has been unpacked here! At the end of the day, it is crucial to ensure that you are keeping up to date with these plans (both ones that are in effect and future ones) and how they might impact you, on an immediate level but also for months and years to come.

Back in December (which already feels like months ago somehow) I teamed up with my friends over at Hallo to put together a series of events to help y'all Level Up Your Lifestyle in the new year. One of those events was all about financial fitness. We also had social media influencer and content creator Natalie Barbu join us to talk about her own personal journey with finances and learning about how to be financially fit.

So, without further ado, here is the abridged rundown of key terms and takeaways from our financial fitness event!

TIP: Free resources for budgeting include Mint and Napkin Finance Money 101 course

There, you have it. The quickest of quick event takeaways! This run-through on financial fitness is just a scratch on the surface. Head here if you want to take a look at the full presentation from the workshop itself.

Finally, here are some additional resources to help you become more financially literate and fit in 2021!

How to Make Money While You're Still in College

Whether you’re just starting college this year or you’re already an upperclassman, it is likely that you have already acknowledged at least once (if not many more times!) how expensive college can be. Between buying textbooks, covering tuition and room & board, and paying for food, we know how it feels to be on the struggle bus when it comes to having money in college. Luckily, there are many possibilities for making money while you’re in school, even if you are a full-time student. Read on to learn more about how you can earn a few extra bucks to help you fund your education (to complement all of your scholarship winnings, we hope ????)!!

Looking at the resources offered on your school’s website is perhaps the easiest place to start your search for earning money. Most colleges and universities have a section of their website dedicated to student resources.

While this page may look different across each school, its general goal is to allow students to browse on-campus jobs, to learn more about work-study programs available, and to read about job placement opportunities. A few of the most common jobs we’ve found on these student job boards are for Teacher’s Assistants, Tutors, RA’s (Resident Advisors), Campus Tour Guides, and various positions in campus buildings.

You may also be wondering about work-study programs and where they fit into the equation here. Federal work-study is a way for undergraduate and graduate school students with financial need to earn money to put towards paying for their education. The work-study section of your school’s website is likely to be separate on the page from the normal job board (and may even be in a different location altogether), so be on the lookout for that resource!

Aside from on-campus jobs and opportunities, one popular way that many students choose to earn cash for college is through working for a delivery service. These jobs are often great for college students because they allow you to work flexible hours. You may have access to different opportunities depending on where your school is located, however, it is likely that at least one of the most popular companies operates in your area. The majority of these positions require you to have a car, bike, or scooter to make deliveries but depending on where you live, you may be able to deliver on foot. Check out the opportunities listed below if a food delivery job sounds interesting to you!

Another option for earning money while you’re in college (that you can even do from your couch!) is taking surveys. Each website offers different payouts for certain types of surveys; a shorter survey might pay $.50 or a few bucks, whereas a longer and more intensive survey could put $50 in your pocket on the spot. Popular survey websites include Survey Junkie & and Swagbucks.

Last, but certainly not least, there are a bunch of other options that students can pursue to make some extra cash, such as: