The COVID-19 pandemic has successfully inserted itself into essentially every aspect of our lives at this point, and unfortunately, it has mostly not been for the better, although any optimist will likely be quick to highlight those few gold nuggets and silver linings.

One particular area of the population that has been struggling to navigate these turbulent times is the area containing prospective, current, and recently graduated college students. With the costs of higher education only on the rise and the rough circumstances of the pandemic leaving millions of people jobless or furloughed until further notice, families are struggling to come up with the funds to pay for or pay off college-related expenses.

Enter all the news on newly-elected president Joe Biden’s plans and proposals to both provide some much-needed relief to those being weighed down by the burden of thousands in student loans while also lowering the costs of tuition for many current and future college students.

In this post, I will highlight several areas of Biden’s currently enacted and proposed plans as they relate to student loans, college tuition, and higher education in general. Keep reading for the tea!

During his first day in office, President Joe Biden made the move of extending student loan payment forbearance to September 30, 2021, a decision made primarily due to the pandemic and its detrimental impact on millions of Americans.

Essentially, this means that the majority of federal student loan payments are on pause, and any new interest on loan balances will be waived.

In addition to this push back on the date, Biden and his team are also pushing for an immediate canceling of $10,000 of student loan debt for all, a move which would “wipe out debt completely for nearly 15 million borrowers who owe $10,000 or less” (Nerd Wallet).

Along with the immediate $10,000 cancellation, Biden has also recommended that federal student debt should be completely canceled for borrowers who attended a public college or university and currently earn less than $125,000.

One important thing to note about this recommendation is that it does not apply to graduate school tuition.

Essentially, Biden’s revised plan proposes that borrowers would not have to start paying back their loans until they earn an annual income of over $25,000.

Once borrowers earn over this number, their repayment plan would then cap at 5% of disposable income, a much more reasonable number than the current options, in which the minimum is set at 10% of disposable income.

Not only is Biden proposing to make monthly student loan payments more reasonable, but he is also pushing to make it so the remainder of your student loan balance will be automatically forgiven after 20 years of payments.

This is in comparison to current repayment plans, which offer forgiveness after 20-25 years of payments.

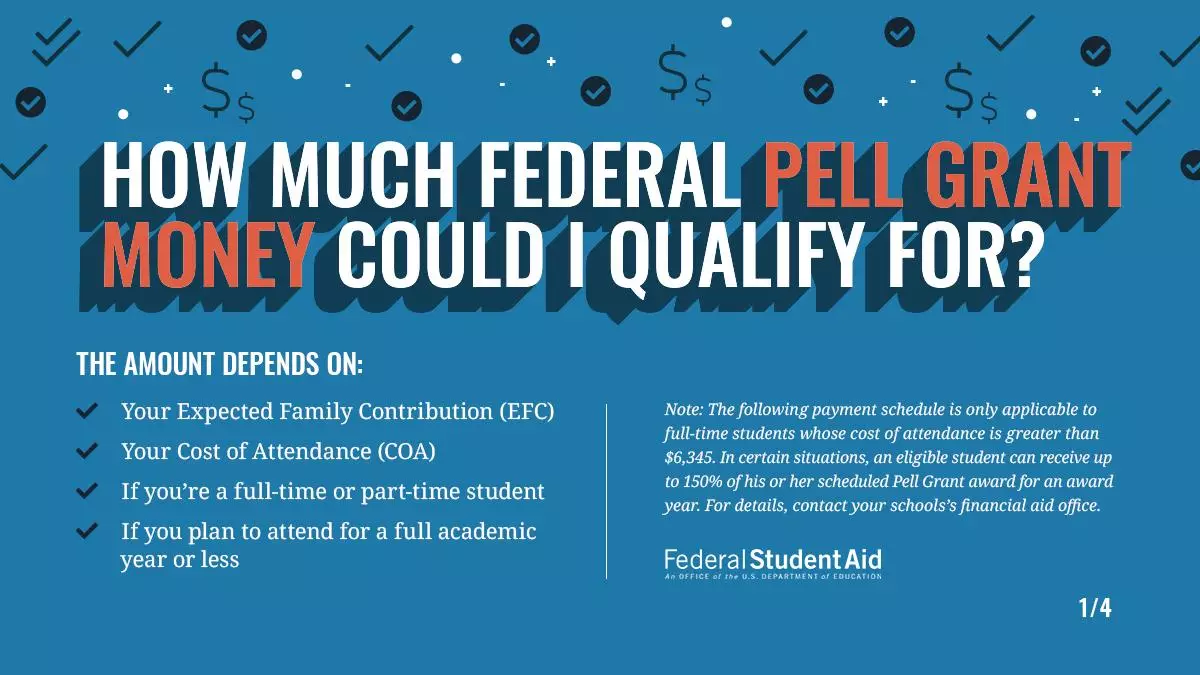

Students whose family incomes are less than $60,000 per year are eligible for either some or all of a Federal Pell Grant, which is currently worth $6,345.

While this is a great help, it still leaves quite a bit of tuition and expenses on the table for the majority of students attending four-year colleges.

Biden hopes to increase this number while simultaneously loosening the eligibility rules so that Pell Grants can be given out to more “middle-class” students.

Perhaps the most noteworthy part of Biden’s plan is his proposal to make undergraduate tuition-free for students who fall into the following areas:

1) if you attend a public college or university and your family income is below $125,000 (4 years tuition-free)

2) if you attend a community college (2 years tuition-free), and

3) if you attend an HBCU or a tribal college or university (2 years tuition-free).

Students should note that these free college tuition plans do not include non-tuition expenses such as room and board, textbooks, and other fees.

So, I’ve covered quite a bit of information regarding Biden’s current and potential future plans of action as they relate to student loans and college tuition.

I’d be remiss to end this post without quickly elaborating on exactly how these current and future plans can actually impact you! Here’s the lowdown…

If you are a college graduate and you have debt - congrats! Well, not about the debt, but because Biden’s extension of student loan payment forbearance means that if you are not currently in the position to be paying off your student loans, then you can put that worry on the back burner for a few more months.

Lots of people have been asking questions along the lines of “If I am still in a position to be paying off some of my student loans during these difficult times, should I be doing so?”.

Since I am very admittedly no financial expert, here is a little nugget of advice that I found while perusing Student Aid’s section on Student Loan Payment Forbearance:

“Continuing to make payments during the payment suspension could help you pay down your loan balance more quickly because the full amount of a payment will be applied to principal once all interest accrued prior to March 13, 2020, is paid.

You may either leave your loans in the “administrative forbearance” status (meaning the requirement to make payments is suspended) and make payments anyway, or opt out of the administrative forbearance/suspension of payments and continue to make payments.”

- (Studentaid.gov)

If you’re looking for a more in-depth answer, I highly suggest clicking the hyperlink above and reading through all of the Q & A’s on COVID Forbearance and how it all works. If you have any other questions that Student Aid has not covered, be sure to reach out to your specific student loan servicing company to get those clarified.

If you are a current college student - Now, if you are still enrolled as an undergraduate student at a college or university, unfortunately, Biden’s current plans and hopeful proposals in relation to paying off student loans don’t quite impact you just yet.

Usually, you are not required to start paying off student loans until an average of 6 months after you have actually graduated, so even if you’re a college senior graduating this May, Biden’s extension likely won’t impact you too much either, unless it gets extended again of course!

If you are a future college student - Pay close attention to the latest news and updates on Biden’s plans to hopefully expand the eligibility rules for students qualifying for federal Pell Grants as well as information on actually transitioning to making college tuition-free for students under certain circumstances.

So, quite a bit of information has been unpacked here! At the end of the day, it is crucial to ensure that you are keeping up to date with these plans (both ones that are in effect and future ones) and how they might impact you, on an immediate level but also for months and years to come.