Student loans are just one of the many options that students have at their disposal in terms of ways to pay for college. Here at Access Scholarships, it makes sense that so much of our content revolves around scholarships - aka, free money, aka, the hands-down BEST way to pay for college!

But, as a student making a big monetary investment in your higher education, it’s important to make sure that all paying for college options are explored, understood, and compared. After all, the ultimate goal is to get YOU across that graduation stage with as little debt as possible.

In this student loan guide, you’ll find everything you need to know about, well, student loans!

The guide starts slow, by introducing and explaining the basics on student loans, including everything they ARE and everything they ARE NOT. Then, we move on to discuss different types of student loans (hint: there are tons of federal and private student loan options out there).

Next, we’ll set you up with all of the information and resources you need to compare student loan packages, so that if you do take out loans, you are making the best possible choice. Finally, we will conclude by answering some of the most common and frequently asked questions about student loans, including how to apply for them, how they affect your credit score, and more.

To put it simply, a student loan is money that students borrow from an entity (a bank, the government, an individual, etc) to pay for your college costs. When you take out a loan, you are borrowing this money. Therefore, the expectation is that, at some point in the future, you are to pay back the money that you borrowed from the given entity, with interest.

Now, what does interest mean?

Interest is the additional money that you owe a given lender for actually giving you the money to borrow in the first place. When it comes to all types of loans (not just student loans), it’s important to keep in mind that a lower interest rate (all else aside) is optimal, because this means that you will owe less additional money back to the lender at the end of the loan’s term.

Student loans can most easily be recognized as falling into one of two categories: federal or private. Generally speaking, federal student loans have more benefits for students than the majority of private student loans (given out by banks and other sources).

Despite this, it’s important to learn about each so you can be fully in the know and accurately compare your options. Keep reading to learn more about each loan type and everything that comes with it.

A federal student loan is one that you may choose to take out through the federal government. In this case, the Department of Education is your lender.

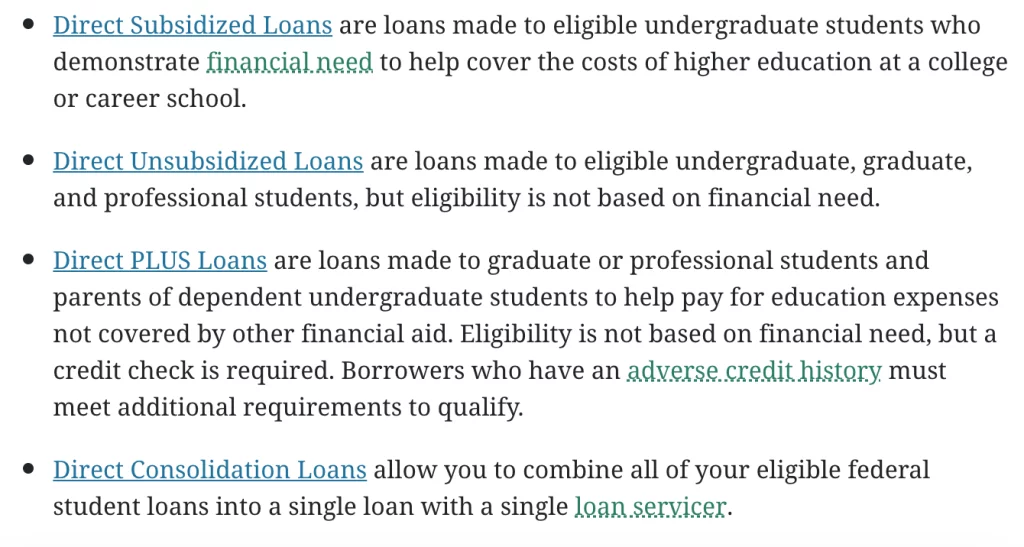

There are four main federal direct student loan offerings. Since the StudentAid.Gov website summarizes this information best, here is a screenshot listing each loan and the basics behind it:

The current interest rate for both Direct Subsidized and Direct Unsubsidized Loans is 3.73%, and this percentage is fixed for the entire life of the loan. Here are a few important differences between Direct Subsidized and Direct Unsubsidized loans to keep in mind:

Your higher education institution determines which loans you’re eligible for as well as the maximum amount that you can hypothetically take out through each in a given year (this is called the annual loan limit).

However, the amount of loans that you personally are eligible to take out ultimately depends on your year in school and your dependency status (independent or dependent).

To apply for federal student loans, all you have to do is make sure you file your FAFSA each and every year that you’re in school (you start as a high school senior though!).

Once you file the FAFSA, your school will send you a financial aid package that is customized to fit your financial needs. This may or may not include federal loans, among other things such as scholarships and grants and federal work-study options. If it does include federal loans, you’ll want to follow the designated steps to learn more about the loans you qualify for, which ones are best for you, how you can go about accepting them, and everything that comes next.

A private student loan is a loan that is taken out from any institution that is not the Department of Education, such as a bank, credit union, or school, just to name a few.

There are dozens and dozens of options out there for private student loans, which, to be honest, can make the process of choosing the right one(s) stressful.

A few popular private student loans options include loans by Sallie Mae, Ascent Funding, Discover, MPower, and Earnest. Use the widget below to compare private student loan offerings to see which is the best choice for you:

As with federal student loans, the amount that you can borrow from any given private lender varies depending on several factors, such as your/your co-signer's credit history and income and school’s cost of attendance.

Unlike with federal loans though, there are some private loan lenders that will allow you to take out loans in the full amount of your tuition. Just because you CAN do this, though, certainly does not mean that you should! After all, the aim of the game is to graduate with as little student debt as possible, which means taking out loans for only the amount that you truly need.

The process for applying for federal student loans is quite simple - all you have to do is file your FAFSA (make sure you do it before the deadline!). Conversely, applying for private student loans requires a few different steps:

Step 1: Start by comparing the private loan options that are at your disposal, using the tool above.

Step 2: Once you have compared your options and determined which ones might be best for you, make sure that the loans you’re considering work with the school that you’re attending.

Step 3: At this point, once you have confirmed that the lender is compatible with your institution, you can apply directly on the company or organization’s website.

While private and federal student loans both accomplish the same goal of providing you with money to help you cover your college costs, there are several key reasons why federal student loans should be your first option if you decide to take out loans.

Federal student loans generally offer the best deal in terms of interest rates (they are usually fixed) and repayment plans (often are driven by your post-graduate income). Plus, with federal loans, there’s even the potential for student loan forgiveness.

Bottom line: always explore your federal student loan options before looking at private offerings. If you have exhausted all of the federal loans at your disposal, you can then start researching and comparing private student loans - enter your school name above to get started!

When you take out student loans, you are borrowing the money to pay for your education, with the expectation that you will pay that money back to the lender in full, plus interest, at some point in the future.

Taking out loans for school is a big step. Before you make any big moves in one direction or another, make sure you know and understand the following tips and tricks:

Make your payments on time! Make sure you know how much of your loan needs to be paid each cycle, when it’s due, and how to pay it.

While this page heavily revolves around student loans, it’s important to remember that taking out loans is just one of the many paying for college options that are out there.

Ultimately, due to the fact that loans are money you borrow (and must be repaid with interest!), we will always suggest that you explore all of the options at your disposal (scholarships, work-study programs, using money saved) before going straight to the loan office.

By starting early in having those important paying for college discussions and figuring out your options, you will give yourself the best chance to graduate from college as close to debt-free as possible.

Apply for our TWO easy, no-essay scholarships:

Once you've applied for those easy scholarships, head over to our Scholarship Search to find more scholarships that are a good fit for you.

Done with that, too? Check out some of our popular scholarship-related blog posts:

Sources: Student Aid, Sallie Mae, Citizens Bank, White House