The FAFSA, otherwise referred to as the Free Application for Federal Student Aid, is what I like to call the key to unlocking federal financial aid that comes in the form of loans, scholarships and grants, and federal work-study.

The FAFSA is always one of those college-related topics that students and parents have quite a few questions about, which is completely fair because the process can DEFINITELY be confusing.

Despite the fact that there are various deadlines in which the FAFSA has to be completed, there is one specific day where the FAFSA becomes available to everyone, including high school seniors, undergraduate, and graduate school students.

The FAFSA opens on October 1st of each academic year.

This is the first day that students and parents can log on to start filling out all of the required forms and information in order to be considered for federal financial aid.

Ideally, you should aim to have your FAFSA completed and submitted ASAP after the October 1st opening date. By getting it done early (way before the final FAFSA deadline is ideal), you're giving yourself the best chance at receiving all of the financial aid that you are eligible for, based on your EFC and other factors.

However, one thing worth pointing out is that if you’re trying to log on to complete the FAFSA within the first few days that it’s open, you might have a hard time doing so.

Since so many students and parents are usually trying to access the website’s servers during these early days, the website is prone to crashing or just loading very slowly.

So, I recommend giving yourself about 5 days after the form opens before going on to complete it. This is actually okay because it gives you a solid amount of time to sit down with your family, talk about the financial aid process, and start gathering all of the necessary paperwork and information that you need to actually file the FAFSA.

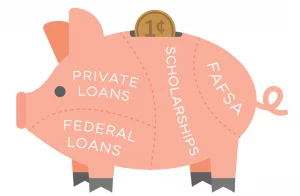

Federal financial aid provides students with numerous options in terms of need-based grants, loans, and federal work-study. However, for students looking to earn as much aid as possible to pay for college, there are a few other options out there worth exploring.

The first is private scholarships. These are scholarships that are offered through companies, non-profits, small businesses, institutions, and other non-federal or state-based aid organizations, and the Access Scholarships search engine is a great place to start to find out more about these opportunities.

If you’re somewhat new to the scholarship search process, you might also want to check out some of my blog posts, like Scholarships for Women, No-Essay Scholarships, and Scholarships for College Freshmen, since they are easy reading-type resources to help get you acquainted with the process, and the types of organizations out there offer scholarships.

Outside of the scholarship space, there are also private loans, which are essentially loans that are not offered through the federal government.

Although these loans tend to get a bad rap, they shouldn’t! They are an extremely common source of funding to help students pay for college, and, if you do your research, you can find yourself some great private loans with favorable interest rates that won’t leave you with a hefty debt bill in a few years time.