The Free Application for Federal Student Aid, more widely recognized by its acronym “FAFSA”, is the key to unlocking federal financial aid that comes in the form of loans, grants (in this case, mostly need-based), work-study programs, and more. One of the most common questions I hear students and parents ask in relation to federal aid is “When is the FAFSA due?”

While this question does have a concrete answer, it also has a more nuanced one. So, in the spirit of making this as clear as possible, let’s start with the concrete one.

According to StudentAid.gov, the annual FAFSA deadline is June 30th of each academic year.

Essentially, June 30th is the very last day that you can have your forms submitted on the Student Aid website for any given year if you want to be considered for federal financial aid.

My tip? Start your FAFSA earlier in the year, and aim to have it submitted within the first two months of the form becomes available. For reference, the FAFSA goes live on October 1st of each year.

The FAFSA form must be submitted by 11:59 p.m. CT on June 30, 2024. Any corrections or updates must be submitted by 11:59 p.m. CT on Sept. 14, 2024.

Each college may have its own deadline. Check with the college(s) you’re interested in attending. You may also want to ask your college about its definition of an application deadline. Is it the date your FAFSA form is processed or the date the college receives your processed FAFSA data?

Each state has its own deadline.

Now that you have the straightforward, last possible deadline to submit the FAFSA in your head (and hopefully in your calendar!), let’s discuss the more nuanced answer to the question: When is the FAFSA due?

When you submit the FAFSA, it doesn’t only get utilized by the federal government to help determine how much aid you’re eligible for.

Completing the FAFSA is also what allows you to be considered for state-based aid, as well as specific scholarships offered by each individual college and university that you’re applying to. Because of this, each state and each institution has its own specific deadline (before June 30) that the FAFSA needs to be completed by.

Some states have their FAFSA deadlines listed on the Student Aid website, whereas other states direct you to find the deadline information on the financial aid portion of your intended or current institution’s website.

Overall, most states indicate that you should try to get your FAFSA in and completed “ASAP after October 1st”.

The main reason why it is critical to have your FAFSA completed and submitted as close to October 1st as possible is that most states and institutions don’t have an unlimited amount of financial aid and scholarships to disperse.

In most cases, this aid is given out on a first-come, first-serve basis, so, by filing your FAFSA as early as you can, you are giving yourself the best chance at receiving the financial aid that you’re eligible for, based on your EFC, merit, and other factors.

Expected Family Contribution (EFC) is the number calculated with information from the FAFSA used to determine a student's eligibility for financial aid.

Note: Your EFC is not the amount of money your family will have to pay for college, nor is it the amount of federal student aid you will receive. It is a number that schools use to calculate the amount of federal student aid you are eligible to receive.

Gather Your Basic Personal Information

Expect to provide personal information such as your name, date of birth, address, and social security number. Depending on whether or not you’re a U.S. citizen or tax returns filed, you may need to provide additional information. Either way, have the following information ready when you begin filling out your application:

In addition to the aid that you can possibly receive by filing the FAFSA, there are a few other potential sources of financial aid that are definitely worth exploring, including private scholarships and even private student loans.

If you’re looking for some easy places to start with searching for private scholarships, check out some of my popular posts, like Scholarships for High School Juniors, Scholarships for High School Seniors, No-Essay Scholarships, STEM Scholarships, Full-Ride Scholarships, or Scholarships for Minorities.

There are dozens of more posts like these on my blog, so if it’s free money you’re wanting, don’t hesitate to check them out.

While the words “private loans” tend to be frowned upon and viewed as a last resort in paying for college space, this doesn’t mean that there aren’t viable options out there to be explored. If you have exhausted all of your federal student loan options, organizations like Ascent Funding and MPower offer private loans that are geared towards students. If you have graduated, be sure to check out the best student loan refinance companies.

While preparing for your first (or subsequent) year of college is often an exciting journey, the process of planning, researching, and figuring out how to pay for college can turn it into a stressful one.

In this post, we'll answer the most common questions students and parents often have when it comes to filling out the FAFSA and applying for financial aid. Plus, at the very end, you'll even get some bonus resources and extra recommended reading to help you get ahead and stay on track.

FAFSA stands for Free Application for Federal Student Aid. Once you have filled out this form, colleges and universities you're applying to (or the college you currently attend) will take your information and use it to determine your eligibility for receiving federal financial aid to help you pay for school.

It's important to note that, despite the fact that some private scholarships may require FAFSA completion in order for you to be considered, these are not the types of opportunities that you will automatically be considered for when you file the FAFSA.

If you're looking for private scholarships of all kinds, check out my blog (posts such as Scholarships for High School Seniors, Scholarships for Women, and No Essay Scholarships are a great starting point!).

The FAFSA form is available on October 1st of each year, and you fill it out for the first time as a senior in high school.

The national FAFSA deadline for the 2022-2023 year is June 30th, 2022. However, many schools and states have their own, earlier deadlines for the FAFSA, so it’s super important that you take note of those deadlines so you don’t miss them.

Many institutions (and state-based organizations, which often require you to have filed the FAFSA) give out financial aid on a first-come, first-serve basis. So, In order to maximize your chances of receiving aid to pay for school, I recommend that you complete the FAFSA as soon as possible after the application opens.

There are several eligibility requirements that students must meet in order to be eligible for federal aid through the FAFSA. The two most important requirements are related to citizenship and financial need.

In terms of citizenship, the FAFSA is available to US citizens, permanent residents, and eligible non-citizens. It is not open to international students planning on studying in the US, nor is it open to students with DACA/undocumented status.

Financial need is defined by Student Aid as the difference between your school's Cost of Attendance (COA) and your Expected Family Contribution (EFC). The majority of financial aid programs run through the federal government received go to students with the highest levels of financial need.

The process of submitting your FAFSA may seem daunting, but if you follow these steps, it doesn’t have to be!

Your FSA ID is a username and password that allows you to easily access your FAFSA form, the myStudentAid app, and more. Creating your FSA ID takes just a couple of minutes, and we highly recommend you create your ID before you sit down to fill out the FAFSA, as this will cut down on potential delays in the process.

*Important note* If you are a dependent student, one of your parents will also need to create his or her own FSA ID (the parent who creates the ID should be the one whose information is reported on the FAFSA form) in order to be able to sign your application once you have finished filling it out.

According to Studentaid.gov, the following documents or information may be helpful to have on hand as you fill out the FAFSA:

-Your SSN (Social Security number) AND your parents’ SSN if you are a dependent student.

-Your driver’s license number, if applicable.

-Your Alien Registration number if you are not a U.S. citizen

-Tax information or returns for both you AND your parents (parental tax information needed for dependent students only). This includes the IRS W-2 and 1040, and possibly other information depending on the state and country you live in.

-Money and banking information such as:

It is crucial to make sure that you have all of this information on hand and organized for when you go to fill out the FAFSA.

*Tip from me: Print out all necessary documents and information, label them, and store them in a folder that you can both easily access and keep somewhere safe so it won’t get lost or damaged. If you want to save some trees, consider organizing everything into a folder on Google Drive that you can easily share with your parents.

Students have four options when it comes to filling out the FAFSA:

I recommend either applying online at fafsa.gov or using the mobile app.

When you are filling out the FAFSA, you will see that you must list at least one school to receive your information. Each school you list on your form will use your information to determine how much and what types of aid you are eligible to receive.

When you fill out the form online or in the mobile app, you can list up to 10 schools, but be aware that if you fill out the form via PDF, you may only list up to 4.

Simply put, you should list any school that you are planning on applying to on your FAFSA form, regardless of whether or not you have been accepted.

Quick tips for filling out the FAFSA:

-Double and triple-check that your name and SSN match what is listed on your Social Security card

-Make sure you enable pop-ups from fafsa.ed.gov to ensure that the application functions properly

-Create a save key at the beginning of the application, which you can use if you want to complete the form in multiple sittings while still saving your information as you go. Make sure you write your save key down!

Make sure that you sign in with your FSA ID when you go to sign and submit your FAFSA, as this will ensure that the form is processed correctly and quickly.

Once you have submitted your form, you should automatically receive a confirmation email (check your spam/junk mail too!).

*Tip from me: If you have a sibling who also needs a FAFSA form filled out, check your confirmation page for the option to have the parent information transferred to the other student’s application.

Once you have submitted your FAFSA, you can log into your account at fafsa.gov (with your FSA ID username and password) to check on the status of your application.

Within a few weeks of submitting your application, you should receive your Student Aid Report (SAR), which is essentially a summary of all of the information you submitted in your FAFSA. It is your job to go through your SAR and make sure all of the information is 100% correct!

Once you have been accepted to a college or university that was listed on your FAFSA, that school will send you either an electronic or paper offer (aka award letter) which will tell you how much aid you are eligible to receive.

*Tip from me: Once you have received your award letter, it is important to go through it and understand exactly what types of aid are being offered (loans vs grants/scholarships), what aid you really need, and then decide what you are going to accept.

Now, you should be fully versed on what the FAFSA is, how to fill it out, and what to do once you have received your aid offer. For more information on the FAFSA, check out our bonus resources below!

Before we get into the nitty-gritty of Pell Grants, let’s first clarify some of the basics.

What is a Pell Grant, anyways?

Pell Grants are subsidies given out by the U.S. federal government to help students from lower-income families pay for college. Unlike normal loans, Pell Grants usually do not have to be repaid.

However, there are a few reasons why your Pell Grant may have to be repaid, such as if you withdraw from your program early or if you receive outside scholarships or grants that reduce your need for federal student aid.

The purpose of the Pell Grant is to ensure that “higher education remains accessible to all”; therefore, Pell Grant recipients must prove that they fall into a specified level of financial need.

To determine your level of financial need, you will be required to fill out the FAFSA (free application for student financial aid). For reference, the FAFSA should get filled out the first time when you are a high school senior, and you must reapply for every year you are enrolled in college in order to receive funds.

The process of filling out the FAFSA will then determine your eligibility for the grant.

Generally, the majority of Pell Grant recipients come from households with total incomes of less than $25,000 per year.

The amount of the grant can vary from year to year; for the 2020-2021 year (July 1, 2020 - June 30, 2021), the maximum amount any student can receive is $6,345.

According to Studentaid.gov, the amount you can expect to receive depends on a number of factors, such as:

For more information on how the amounts are determined, visit this link to view the tables for the 2020-2021 award year (calculated by the U.S. Department of Education).

Once you receive a Pell Grant, in order to maintain it (aka, keep the money!), you must maintain your enrollment in a U.S. undergraduate program.

Additionally, you must make sure to fill out the FAFSA form each year you are in school, which ensures that you are still eligible for federal student aid.

More information on the FAFSA is available here.

Now that you know everything there is to know about the Pell Grant, if you believe you may be eligible, follow the steps below to apply!

With that, I'll leave it to you. Happy applying!

Luckily, you've come to the right place!

In addition to the resources on my blog about all things financial aid and paying for college, I also have a great scholarship search engine tool that you can use to find awesome opportunities to apply for.

There are scholarships out there of all kinds (ranging from easy to competitive), for students of all years (think: high school juniors to graduate students), and for all amounts (from $500 awards to full-rides).

Also, if you want to stay updated on the latest scholarship opportunities, I recommend you check out and throw me a follow on Instagram, where I post about awesome scholarships on the reg!

The FAFSA, once completed (hopefully with plenty of time before the deadline!), opens the door to a wide variety of types of federal financial aid. The three main categories are loans (subsidized and unsubsidized, PLUS, and consolidation), grants, and federal work-study.

In this post, I will go through each of these three categories and specify which need to be repaid, and which don’t.

Generally speaking, grants you receive from the FAFSA (Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), Teacher Education Assistance for College and Higher Education (TEACH) Grants, and Iraq and Afghanistan Service Grants) do not need to be repaid.

There are, however, a few possible situations in which you might have to repay specific grants that you receive.

For example, if you accept a TEACH grant (this is usually geared towards education majors/students who want to become teachers) and you do not fulfill the full-service obligation, the grant will turn into a loan which you then have to repay with interest.

A loan is defined as money that you borrow from an entity that must be paid back with interest. Each of the various types of loans that are offered and available to students through the FAFSA has its own specific repayment conditions, and they all do require repayment.

Despite this, there are some situations in which you might qualify to have your part (or potentially all) of your federal student loans forgiven, canceled, or discharged.

The best place to learn more about all of those possible situations, for each of the different types of student loans, is on the Student Loan Forgiveness page of the Student Aid website.

Lastly, if you have private student loans, especially with higher interest rates, you may want to look into a private student loan consolidation.

Federal work-study is a program in which you work part-time while you are attending school to help you cover some of your education-related expenses.

Work-study program availability varies by school, but the important thing to know is that the money you earn through your part-time job goes directly to pay off your expenses, and does not need to be repaid.

The FAFSA may come with its fair share of confusing qualities (talking from pretty recent FAFSA experiences here!). However, you will be glad to know that navigating the process of adding schools to the FAFSA form is not one of them!

If you’re wondering how to add schools to the FAFSA, keep reading to learn exactly what you need to do, plus the answers to some other important questions related to this same topic.

When you file your FAFSA, you must list at least one school that you want to receive your financial information. If you are filing the FAFSA for the first time, then you will see the step to add schools come up as you go through the process of filling out all of the necessary information.

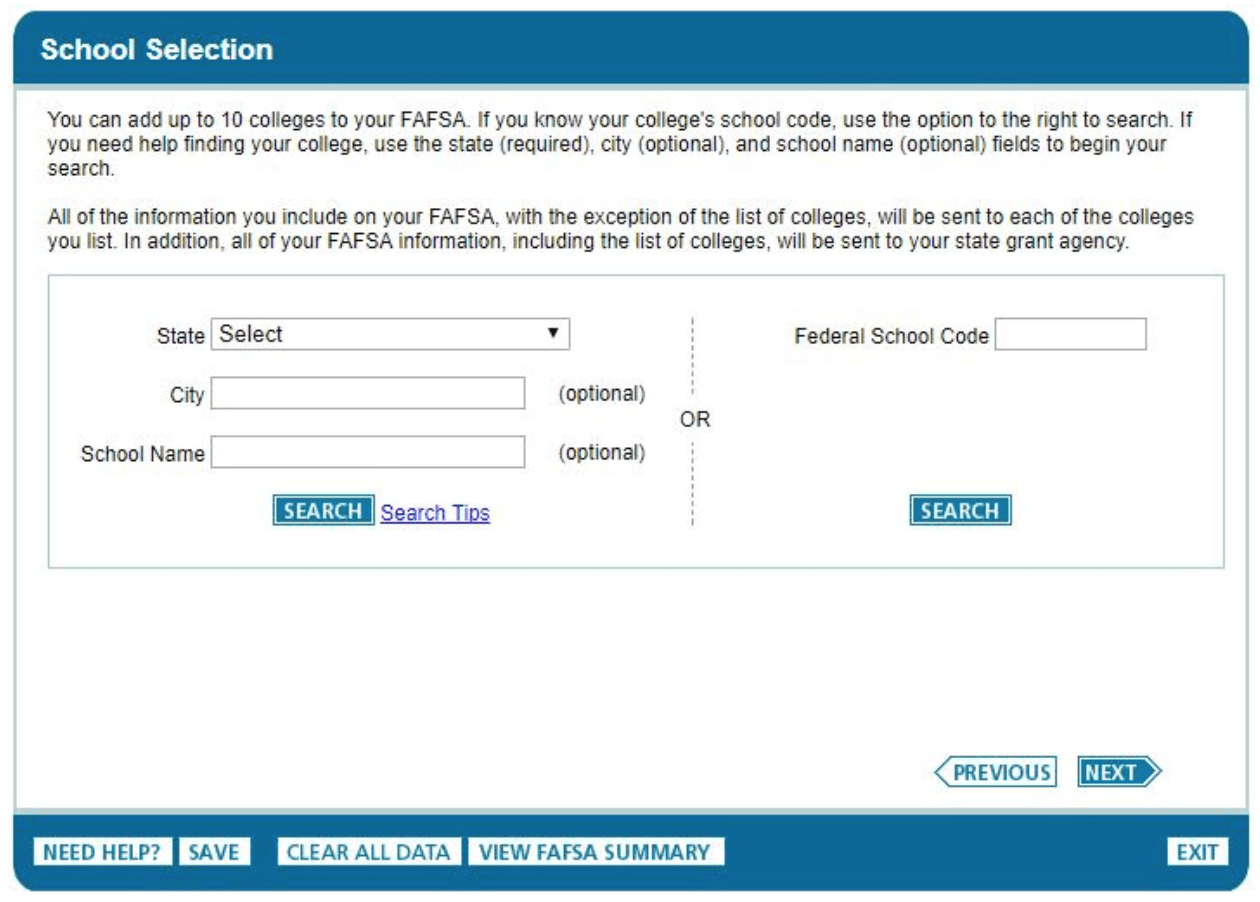

The page where you will add schools looks something like this:

From here, the process of adding your desired schools is pretty straightforward.

However, you’ll want to double-check at this stage to make sure that the schools you’re adding are all, in fact, the schools that you plan to apply to.

For example, if you’re applying to the University of Wisconsin-Madison, make sure that you select Madison, not Eau-Claire, Oshkosh, or one of the several other options that come up under “University of Wisconsin”.

You may list up to 10 schools on your FAFSA in which you want to receive your financial information.

It is important to note that each individual college and university will only receive your financial information, so they will not be able to see which other schools you listed on your form.

If you’re planning to apply to more than 10 schools, the best way to approach this situation (in my opinion) is to list your top 10 schools on the form when you submit it for the first time. Then, once you have submitted the FAFSA and received your Student Aid Report, you have the option to log in to your account to make corrections and add new schools to your list.

Say you add three new schools to your FAFSA. They will automatically take the places of three of the schools that you originally had listed on the form.

This only means that those “deleted” schools won’t have access to any new information that you upload or submit after those schools have been removed. Everything that you uploaded in your original FAFSA form will still be visible by those schools, even if they have been “removed” from your list of 10.

If you already submitted your FAFSA and you realize later on that you forgot to add a school to your form, you can easily make this correction by logging in on the Student Aid website, going to “make FAFSA corrections”, and clicking on “School Selection”.

The FAFSA, otherwise referred to as the Free Application for Federal Student Aid, is what I like to call the key to unlocking federal financial aid that comes in the form of loans, scholarships and grants, and federal work-study.

The FAFSA is always one of those college-related topics that students and parents have quite a few questions about, which is completely fair because the process can DEFINITELY be confusing.

Despite the fact that there are various deadlines in which the FAFSA has to be completed, there is one specific day where the FAFSA becomes available to everyone, including high school seniors, undergraduate, and graduate school students.

The FAFSA opens on October 1st of each academic year.

This is the first day that students and parents can log on to start filling out all of the required forms and information in order to be considered for federal financial aid.

Ideally, you should aim to have your FAFSA completed and submitted ASAP after the October 1st opening date. By getting it done early (way before the final FAFSA deadline is ideal), you're giving yourself the best chance at receiving all of the financial aid that you are eligible for, based on your EFC and other factors.

However, one thing worth pointing out is that if you’re trying to log on to complete the FAFSA within the first few days that it’s open, you might have a hard time doing so.

Since so many students and parents are usually trying to access the website’s servers during these early days, the website is prone to crashing or just loading very slowly.

So, I recommend giving yourself about 5 days after the form opens before going on to complete it. This is actually okay because it gives you a solid amount of time to sit down with your family, talk about the financial aid process, and start gathering all of the necessary paperwork and information that you need to actually file the FAFSA.

Federal financial aid provides students with numerous options in terms of need-based grants, loans, and federal work-study. However, for students looking to earn as much aid as possible to pay for college, there are a few other options out there worth exploring.

The first is private scholarships. These are scholarships that are offered through companies, non-profits, small businesses, institutions, and other non-federal or state-based aid organizations, and the Access Scholarships search engine is a great place to start to find out more about these opportunities.

If you’re somewhat new to the scholarship search process, you might also want to check out some of my blog posts, like Scholarships for Women, No-Essay Scholarships, and Scholarships for College Freshmen, since they are easy reading-type resources to help get you acquainted with the process, and the types of organizations out there offer scholarships.

Outside of the scholarship space, there are also private loans, which are essentially loans that are not offered through the federal government.

Although these loans tend to get a bad rap, they shouldn’t! They are an extremely common source of funding to help students pay for college, and, if you do your research, you can find yourself some great private loans with favorable interest rates that won’t leave you with a hefty debt bill in a few years time.

When it comes to applying for college, figuring out financial aid, and everything in between, it can certainly feel as if there is an ever-growing list of acronyms to label each and every part of the process. There’s certainly no shortage of acronyms for various pieces of the FAFSA puzzle, and in this post, we will dive deep into a few of them.

Perhaps the most important one to know is EFC, otherwise known as Expected Family Contribution.

Your EFC is a monetary number that is calculated based on the financial information you submit on the FAFSA, and it is one of the measurements used to determine how much (and what types of) aid you will be eligible to receive.

Your EFC is calculated by college and university financial aid officers using a specific formula. The formula takes several key pieces of information (that you submit through your FAFSA) into account, including:

The actual formula that is used to calculate EFC is a complicated and intricate one. If you’re interested in learning about the logistics of how EFC is calculated for the FAFSA, this is your go-to resource!

All else aside, having a low EFC on the FAFSA means that you are eligible to receive more financial aid through the government and through your institution.

For the 2021-2022 school year, an EFC at or below $5,846 qualifies you to receive the federal Pell Grant, which is the government’s need-based grant for students with the highest levels of financial need.

Conversely, a high EFC means that you are eligible to receive less financial aid through the government and your institution.

This in turn means that you and your family will likely have to turn to other sources, such as private loans and private scholarships, in order to bridge the financial gap between your school’s COA (Cost of Attendance) and your family income.

Pro-tip: If you’re looking for some easy places to start with searching for private scholarships, check out some of my popular posts, like 50+ College Scholarships, Scholarships for High School Seniors, No-Essay Scholarships, Scholarships for Women, Full-Ride Scholarships, or Scholarships for College Freshmen.

There are dozens of more posts like these on my blog, so don’t hesitate to check them out.

In order to calculate how much need-based financial aid you are eligible to receive, the following formula can be used:

COA (Cost of Attendance) - EFC (Expected Family Contribution) = Need-based aid

You are not eligible to receive more financial aid than the amount that is calculated through this equation. As an example, say your COA is $30,000 and your EFC on the FAFSA is $10,000. This would mean that you are eligible for a maximum of $20,000 in need-based aid.

An important point that is worth clarifying in this section is that need-based aid does not only come in the form of grants and scholarships like the Pell Grant (which do not need to be repaid). It also includes direct subsidized loans, federal work-study, and more.

There are a few possible reasons as to why you might find yourself with a higher than expected EFC on the FAFSA, even if your family is considered low-income.

The first possible explanation is that your family likely has accumulated wealth and investments, such as money in checking and savings accounts, money in the stock market or in bonds, etc.

Another possible attributable factor to a higher EFC in this situation might be that you live in a state with a low state tax rate.

The easiest way to determine how much need-based financial aid you are eligible to receive before you’ve filed the FAFSA is to take advantage of an EFC calculator.